This article appeared in the December 2010 edition of the INNsight newsletter

Article 45 for INNsight newsletter from Peter Wittner, Interpharm Consultancy

Canadian generics – are they overpriced?

The Canadians think that they are paying too much for their generics – are they correct? Certainly some of the evidence from both sides of the Atlantic suggests that they appear to be right.

The really eye-catching headline was the one at the top of a press release that read “Canadians continue to pay almost twice as much as Americans for generic prescription drugs”. This is a surprising finding though, since many US companies and individuals parallel import their branded medicines from Canada because they are cheaper across the border.

The story emerged from a study published in Canada in October by the Fraser Institute, an independent Canadian public policy research and educational organization, which came to the following conclusions:

- Canadian retail prices for generic prescription drugs in 2008 were 90% higher on average than retail prices in the US for identical drugs.

- Of the 64 generic drugs in Canada in 2008 that were compared, 43 were more expensive (average 153%) in Canada, while 21 were more expensive (average 38%) in the US.

- Retail prices for generic drugs in Canada were 73% of the price of their brand-name equivalents, compared with generics being just 17% of the price of their brand-name equivalents in the US.

The study, under the title of “Canada's Drug Price Paradox, 2010” identified what it believed to be the causative factors behind this paradox. The most significant factor, it says, is the way in which the public has been omitted from the process because of government policies.

The authors contrast this with the way that the US system leads to intense competition between retail pharmacies so that there is downward pressure on prices. In Canada, however, the regional authorities set the price at which the pharmacies are reimbursed for generics with all pharmacies receiving the same price. As a result, there is no incentive for retailers to compete and so every pharmacy just charges the maximum price allowable.

Furthermore, the end user does not pay for the prescription so that they too have no incentive to seek cheaper prices or put pressure on the pharmacist to reduce what they charge. Anyone wanting to read the full study and its conclusions can find it at

This study set me to thinking about comparisons with Europe, particularly the statistic that said “Retail prices for generic drugs in Canada were 73% of the price of their brand-name equivalents”. I wondered how this compared with Germany where the local industry association ProGenerika is always keen to publish statistics to illustrate how cheap generics are and to dispel the popular perception and governmental claim that Germany has high-priced generics.

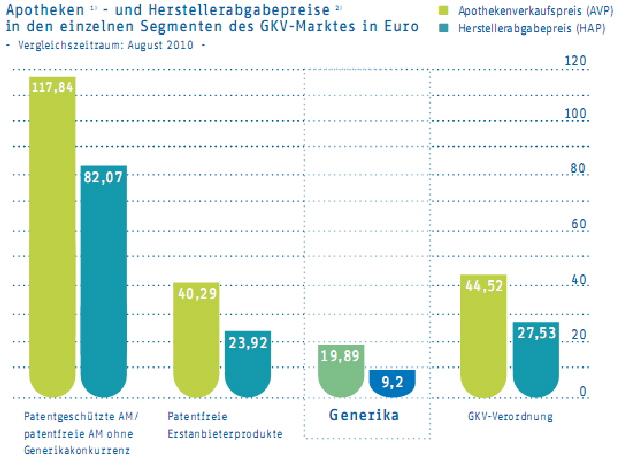

Every month the organisation release figures based on IMS data to show how generics have performed within the overall marketplace and the graphic below illustrates an interesting point to contrast quite sharply with the Canadian findings.

|

Now here is the interesting bit. The average pharmacy selling price for a patented brand is €117.84 and the corresponding average generic price is €19.89 equivalent to 16.9% of the original brand. That is quite a discount (83.1%) compared to the Canadian situation where the generic is 73% of the brand. I recognise that we are talking about averages but even so that is an impressive difference.

At the ex-factory level, the contrast is even greater:

(Generic price of €9.2 ¸ Brand prices of €82.07) = 11.21% or a discount of 88.8%!!

It looks like the Fraser Institute was right.

Peter Wittner

peter@interpharm-consultancy.co.uk