This article appeared in the March 2007 edition of INNSight

The continuing battle over Lipitor

In 2006, Pfizer’s product Lipitor (Atorvastatin) attained sales of US$ 11.7 billion. This was down by 3.6% from the figure for 2005, which disappointed Pfizer but still left it with enough turnover to make it a very attractive target for generic copies.

One copy has already been launched, although not in one of the more sexy markets. In fact, it was in Malaysia by Ranbaxy in September 2006 and so unlikely to cause Pfizer too much pain. Nevertheless, it is significant in that it marked another round in the continuing battler between Ranbaxy and Pfizer over Lipitor.

Pfizer has stated quite openly that it intends to litigate aggressively in order to defend its products. In its 2005 Annual Report, the company stated quite bluntly, while speaking of the interplay between brands and generics: -

“…some of these generics manufacturers are seeking to upset this delicate balance by playing “litigation lotto,” attacking our intellectual property in court after court, hoping to upset a duly-earned patent before its expiration.

Pfizer’s answer? Zero tolerance. No product is too small to be assertively defended. We are now pursuing more than 300 patent infringement cases, filed in more than 50 countries.”

No pussyfooting around there – Pfizer have declared war on companies that try to copy their products before patent expiry. Since pharmaceutical patents in Malaysia seem to be a rather woolly area, Pfizer might not waste too much time in court there. This was not the case in Denmark, though, where Ranbaxy tried again.

Ranbaxy launched a generic Atorvastatin in Denmark on 12 February 2007 through Nomeco, a Danish pharma wholesaler, even though they were still embroiled in patent litigation with Pfizer. Sure enough, Pfizer responded and within a few days, a Danish court granted a preliminary injunction prohibiting the product’s sale. The generic Atorvastatin product was withdrawn from the Danish market pending the outcome of a further patent infringement trial that has not yet been scheduled.

In another indication of Pfizer’s philosophy, Bryant Haskins, a Pfizer spokesman, said “… the Danish market is small by Pfizer standards but that any market is important when Lipitor is concerned”. Understandable, I suppose, when around $12 billion sales are at stake.

Over the last few years, the two companies have slugged it out on battlegrounds across the world including countries such as Austria, Australia, Ecuador, Finland, Norway, Peru , Romania, Spain and of course the UK and USA.

On balance the scores seems to be Pfizer 2 – Ranbaxy 1 because Pfizer is still holding on to its vital product patent while losing some lesser patents such as those on enantiomers. In fact, the score might be 3 – 1 rather than 2 –1 because Pfizer has stopped Ranbaxy launching early in any major market.

Pfizer has a pretty good record of putting its money where its mouth is in respect of defending its patents and the strategy seems to have worked quite well for them so far as a defence against generics.

This is not the only strategy that the company has used for prolonging the life cycle of Atorvastatin. It has also launched a combination product Caduet which contains both Amlodipine Besylate and Atorvastatin calcium (also known as Norvascand Lipitor ).

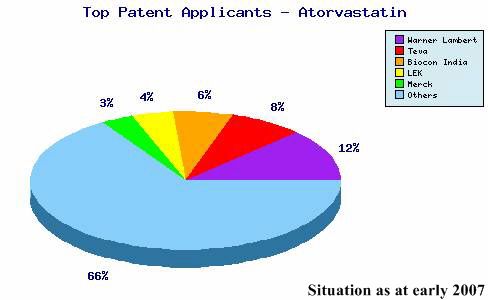

Reverting to the issue of using patents to defend a product, a quick and unsubtle search for patents including the word Atorvastatin in the abstract lists no less than 853! If the criterion of Pfizer as Applicant is added, the number falls to a mere 90 patents. In other words, around 90% of all patents for the product have been filed by other companies who, we must assume, are planning to attack Pfizer’s product rather than defend it since 7 of these are in the name of Ranbaxy!

|

The graph above, supplied by Leighton Howard following a more sophisticated patent search, shows rather nicely the disproportionate number of Atorvastin patent applications made by Pfizer’s competitors.

I think that we can safely assume that the battle will continue since the size of the potential prize in Atorvastatin sales is so huge that even the occasional small victory for Ranbaxy will win them a significant pay off.

If you have any questions or comments

on this article, please do contact me.

peter@interpharm-consultancy.co.uk

www.interpharm-consultancy.co.uk